Loyalty programs: Taxes and Fees

In some cases, it is necessary to set an automatic price increase for the entire product group or for separate goods. For example, you want to include Taxes and Fees in the price of goods. To do this, you can create a list of Taxes and Fees.

Taxes and Fees are a set of values that increase the cost of all items, but you can also adjust the tax amount for each item separately. The values from the list of Taxes and Fees will be used in the Price group (group of goods and base prices). Only after all of the settings are specified, Taxes and Fees will be used when forming the final price.

You can read more about Price Groups in the Price Groups description.

For more information on setting up complex pricing schemes, please, check the Instructions for setting up and using complex pricing schemes.

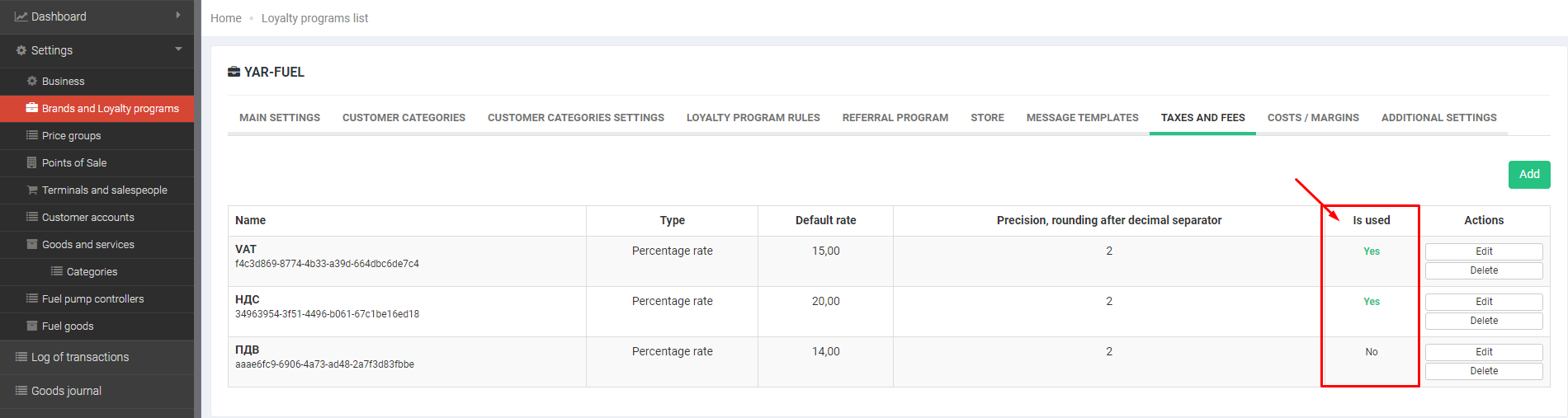

To add a list of taxes, you need to navigate to Brands and loyalty programs => Select a brand => Taxes and Fees.

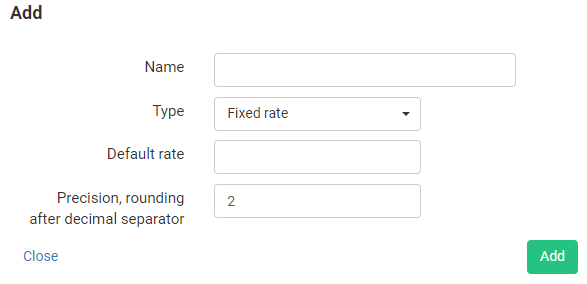

- Name – enter a name that is convenient for you; it is used only in the Control Panel.

- Rate Type – use it to specify the value as being Fixed Rate or Percentage Rate.

- Default rate – specify a numeric value that will become the main one and will be offered by default when creating price groups.

- Precision, rounding after decimal separator – this setting is responsible for the accuracy of calculations, indicating how many characters after the decimal point will be taken for the calculation.

Example: if the number of decimal places is 2 and the rate is 5.65678%, then the effective rate, used in calculations, would be 5.66%.

- Is used – this parameter displays whether this setting is used in one or several price groups.